Financial Management System

Secure, innovative Cash and Treasury Management System

Key Benefits

Boost Productivity

Spend significantly less time and effort on low-value, repetitive tasks. Gain more time to focus on high-value, strategic reporting and decision making.

Single View of Cash

Greatly optimize visibility of cash and bank accounts to make better informed decisions. Eliminate the need to manage multiple access tokens for accessing multiple banking portals.

Better Decision Making

Have all key cash information and indicators at your fingertips. Access timely and comprehensive information to make strategic business decisions.

Key Features

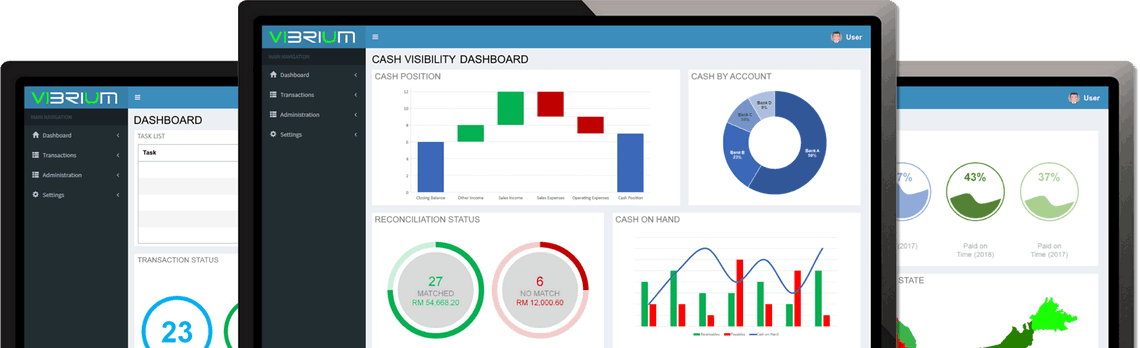

Visibility

- Centralized reporting dashboard

- Data filter, search & sort

- Task views and alerts

Efficiency

- Automation

- Job scheduling

- Mobile transaction notification

- Mobile payment approval

- Batch processing capabilities

Customizability

- Input/ Output file mapping

- Multi-language support

- Customizable dashboards

- Flexible reports

Insights

- Robust dashboard widgets

- Flexible, detailed reports

- Powerful data analytics

Connectivity

- SWIFT & other payment partners

- Direct host-to-host

- Alignment with client bank SLAs

- Interfaceable with leading ERP/ Accounting Systems

Security

- Transmission security

- Data Security

- Application Security

Why Choose Us?

Flexibility

Component based architecture for customizability to each corporate’s unique situation.

Value Driven

Our price structure has been designed to ensure that our clients get what they pay for

Support

Timely and effective support from a team dedicated to understand each company’s business realities.

Deployment Options

On Cloud / On Premises

For further information, please contact us or fill up contact form below and we’ll be in touch with you.

- Import Balances And Transactions From Various Sources

- Reconcile Bank Statements Against Accounting Records

- Generate Timely Reconciliation Reports

- Improve Financial Controls

- Consolidate Cash Across Multiple Accounts

- Gain A Single Window View Of Cash And Liquidity

- Search, Sort, Filter And View Account Balances

- Visualize Cash Position, Location, Currency, Liquidity

- Leverage Cash Visibility To Improve Forecasting

- Allows Manual Entry For Better Forecast Control

- Import External Activity For More Forecast Accuracy

- Alerts To Potential Issues Based On Forecast Results

- Single transaction gateway

- Security and accountability

- On-the-go approvals using mobile app

- Modular approach to upgrading and improving existing ERP or Accounting Systems

- Saves time and money especially for companies who have recently invested in new systems

- Refocus employees from tedious, repetitive tasks to important, strategic work

- Minimize instances of human error or oversight

- Increase response times and overall work efficiency

- Manage payables by instalment

- Optimize payments through analysis of credit terms

- Alerts to mitigate risk of overlooked payments

- Manage debtors to prioritize aging or overdue debtors

- Optimize collection through payment trade analysis

- Import invoices to ensure accurate cash position

- Maintain up-to-date details on each bank account

- Identify unused and unoptimized banking structures

- Perform historical data comparisons

- Perform bank fee analysis

- Monitor account balances

- Perform account sweeping to reduce idle cash

- Efficiently manage notional and physical multi-currency cash pools within the group or company